Payroll

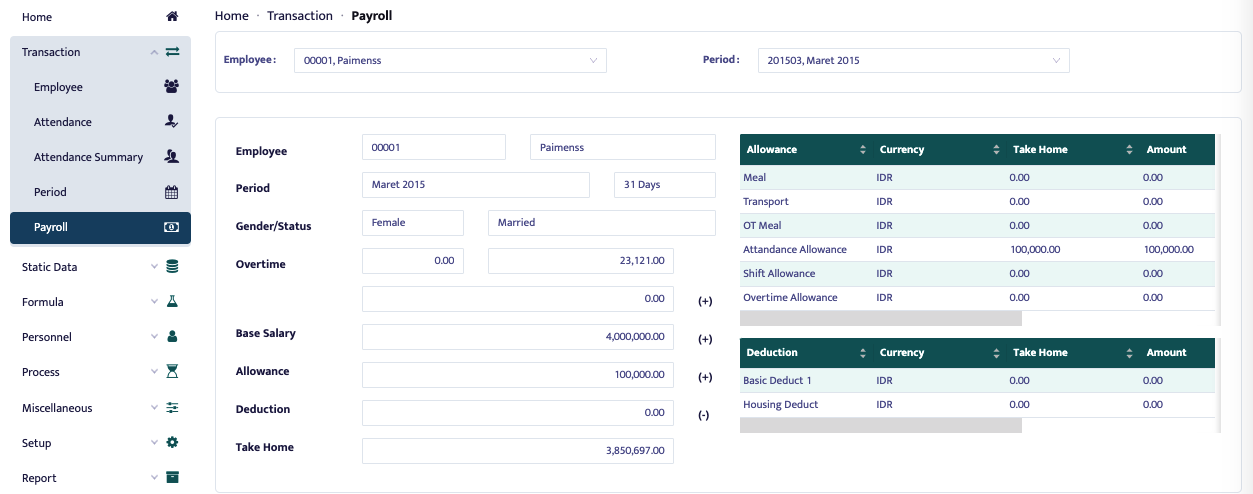

The fifth page of the Transaction Menu Payroll Page contains information on salaries received by employees in a period.

The data in this form is the result of payroll posting, you do not need to add or edit the values in this form.

The payroll form consists of four parts, namely master, sheet allowance, sheet deduction and tab at the bottom left

In addition, there are also Employee, and Period. In the master section consists of

- Employee code and name

- Study period, and total days

- Gender/marital status

- Overtime, claim and rate then total overtime

- Basic salary

- Total allowance, Total deduction, Take home

- net salary, obtained from (overtime + basic salary + total allowance – total deduction – tax - insurance)

Gross

On the Gross tab, there are 5 fields; Allowance, Deduction, Net Salary, Cash Deposit, and Cash Dep Paid. On the assurance tab, there are 5 fields; Gross, Employee and Company Old Age Security (JHT), Work Accident Security (JKK), Company BPJS and Employee BPJS, and death security (JKM).

These insurance values are obtained from the gross insurance in this tab.

Tax Payment

The Tax payment tab contains tax payment information.

- Paid by states that the employee's salary is paid by whom, employee, company or none.

- Gross, is the gross tax

- Title, is the job deduction.

- Allow, is the tax allowance.

- PTKP, non-taxable income, varies according to the employee's marital status.

- Tax, is the amount of income tax paid.

- Tax Paid, is the amount of tax paid.

- Fine Tax, is the amount of tax fine for not having a NPWP. The rate is 20% of the income tax paid.

Bonus Tax

The Bonus Tax tab contains tax payment information.

- Tax Bonus Allow, is the amount of Bonus tax allowance received.

- Gross Bonus, is the amount of bonus received.

- Tax Bonus, is the amount of bonus tax paid.

Overtime

The overtime tab contains overtime information, namely claims and rates. Overtime is divided into two, namely old and current, if a period there is a salary increase or other changes so that the overtime calculation is divided into two, old and new, then this column will explain the old claim and rate, and the new claim and new rate.

Others

The Others tab contains supporting information for payroll posting, namely department, category, position, payment method, currency and marital status.